XRP Price Prediction: Technical Breakout Potential Toward $3.40 Resistance

#XRP

- Technical indicators show consolidation with bullish MACD momentum suggesting potential upward movement

- Growing institutional demand evidenced by record CME futures open interest supports price appreciation

- Regulatory developments and partnership announcements continue to influence medium-term price direction

XRP Price Prediction

Technical Analysis: XRP Shows Consolidation Pattern Near Key Moving Average

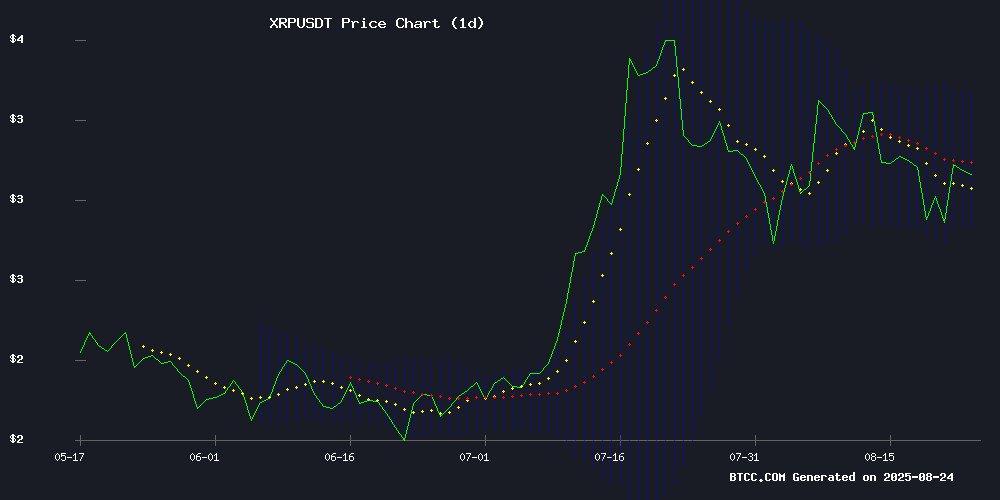

XRP is currently trading at $3.0612, slightly below its 20-day moving average of $3.0952, indicating a period of consolidation. The MACD reading of 0.0848 above the signal line at 0.0383 suggests maintaining bullish momentum, though the histogram at 0.0464 shows some weakening. Bollinger Bands position the price between support at $2.8327 and resistance at $3.3576, with the middle band at $3.0952 acting as a pivot point.

According to BTCC financial analyst Michael, 'The technical setup suggests XRP is building a base around the $3.00 level. A break above the upper Bollinger Band at $3.36 could trigger a MOVE toward the $3.40 resistance zone, while holding above $2.83 is crucial for maintaining the bullish structure.'

Market Sentiment: Mixed Signals Amid Regulatory Developments and Institutional Interest

Recent news highlights both challenges and opportunities for XRP. Regulatory uncertainty continues to create headwinds, while partnerships like Ripple's collaboration with SBI Holdings for RLUSD stablecoin launch in Japan demonstrate ongoing institutional adoption. Record CME futures open interest indicates growing institutional demand, though profit-taking has pushed prices below $3 temporarily.

BTCC financial analyst Michael notes, 'The market sentiment is cautiously optimistic. While regulatory concerns persist, the underlying fundamentals remain strong with increasing institutional participation and product developments like the upcoming XRP-linked Mastercard. The $300 million profit-taking represents healthy market dynamics rather than bearish sentiment.'

Factors Influencing XRP's Price

XRP Struggles Amid Regulatory Uncertainty While Mutuum Finance Gains Traction

Ripple's XRP, a stalwart in cross-border crypto payments, faces persistent selling pressure despite its institutional pedigree. The token hovers near $3.00, trapped between $2.95 and $3.10 as regulatory clouds linger over its U.S. legal battles. Profit-taking from July's highs and capital rotation toward DeFi alternatives compound its stagnation.

Mutuum Finance (MUTM) emerges as a counterpoint, riding DeFi momentum with steady climbs. The divergence underscores crypto's cyclical nature—where established assets cede ground to narrative-driven newcomers. Market dynamics now favor protocols offering yield opportunities over legacy settlement layers.

XRP Targets $3.40 Resistance as Technical Chart Signals Potential Breakout

XRP is testing a critical resistance trendline at $3.10, with traders eyeing a potential breakout toward $3.40. The altcoin's current price of $3.02 suggests it may soon surpass this threshold, marking a new phase in its upward trajectory.

A descending triangle pattern on the technical charts indicates mounting bullish pressure. Analysts note that sustained support above $3.10 could propel XRP toward its next resistance level. The token's inclusion among the Top 100 assets, with a market cap of $180.08 billion, underscores its growing significance in crypto markets.

Dark Defender, a prominent analyst, highlighted XRP's bullish flag formation on November 20, 2024. The token has since gained 14.18%, trading at $2.40 during that analysis. Market participants now watch for confirmation of the breakout scenario.

Ripple and SBI Holdings Partner to Launch RLUSD Stablecoin in Japan Amid XRP Market Struggles

Ripple Labs has forged a strategic alliance with SBI Holdings, a leading Japanese financial services conglomerate, to introduce its RLUSD stablecoin to Japan. The collaboration, formalized through a memorandum of understanding, will see SBI VC Trade—a licensed crypto exchange subsidiary—spearhead the stablecoin's distribution starting Q1 2026.

The move positions RLUSD to become one of the first fully compliant foreign-issued stablecoins in Japan, leveraging SBI VC Trade's unique registration as an Electronic Payment Instruments Exchange Service Provider. Tomohiko Kondo, CEO of SBI VC Trade, emphasized the partnership's potential to elevate market reliability and expand stablecoin options for Japanese users.

Despite the bullish institutional development, Ripple's native XRP token dipped to a three-week low during Friday trading—a paradoxical market reaction that underscores the complex dynamics between project milestones and token performance.

XRP Price Prediction: Whale Activity Forms Correction Base Amid Market Volatility

Ripple's XRP faces mounting pressure after failing to sustain momentum above $3.50, retreating to test critical support near $2.80. Large holders have exacerbated the downturn, offloading 460 million tokens in a week—triggering a 13% price slide. Yet the sell-off reveals surprising resilience.

Technical indicators suggest consolidation rather than collapse. The $2.80-$2.85 zone now functions as a confluence floor, buttressed by the 50-day moving average and value area high. TradingView data shows absorption of selling pressure, with above-average buy volumes confirming institutional interest at these levels.

September 2025 looms as a pivotal timeframe. While whale distributions introduce short-term volatility, the maintenance of XRP's broader bullish structure hints at accumulation disguised as liquidation. Market makers appear to be engineering a higher base before Q4's traditional crypto rally period.

XRP Price Prediction: Analyst Forecasts New All-Time High Amid Market Resilience

Ripple's XRP has rebounded from a key support level at $2.96, demonstrating resilience after a 6.5% downturn last week that saw $105 million in long positions liquidated. The token now eyes a breakout above $3.66, which could pave the way for a push toward $4.

Prominent analyst Steph Is Crypto highlights XRP's consolidation pattern, suggesting an imminent "blow-off top" phase. The token previously reached an all-time high of $3.65 in July. A confirmed breakout could propel XRP into the $4-$16 range, marking a significant upward trajectory.

XRP Futures on CME Hit Record Open Interest as Institutional Demand Surges

XRP futures contracts on the Chicago Mercantile Exchange (CME) have reached an all-time high in open interest, signaling growing institutional confidence in the digital asset. Over 6,000 contracts remained unsettled as of August 18, coinciding with the product's anniversary—a clear indicator of sustained professional participation.

Trading volumes tell a similar story. Cumulative activity in XRP futures exceeded 251,000 contracts over three months, representing $9.02 billion in notional value. The milestone positions XRP alongside Bitcoin and Ethereum in CME's crypto derivatives market, marking a watershed moment for institutional adoption.

XRP Retreats Below $3 Amid $300M Profit-Taking Spree

XRP slumped 3% as investors cashed out over $300 million in profits within 24 hours, breaching the psychologically critical $3 level. The sell-off accelerated after hawkish FOMC minutes revealed Fed concerns about persistent inflation, dampening appetite for risk assets.

Santiment data shows 90% of XRP's circulating supply now sits in profit territory—a ripe scenario for mass liquidation. Exchange inflows surged to $76.8 million, confirming aggressive profit-taking by both long-term holders and speculative traders.

The remittance token's reversal highlights crypto markets' sensitivity to macro shifts. With inflation data exceeding expectations and rate cuts delayed, XRP faces renewed pressure at key support levels that may dictate its near-term trajectory.

Top Reasons XRP Could Hit $10 Sooner Than Expected

XRP is poised for a significant upward trajectory as bullish sentiment grows. Recent developments, including coordinated ETF filings and the resolution of Ripple Labs' lawsuit with the SEC, are driving optimism. Analysts highlight technical indicators suggesting an imminent breakout.

Major asset managers like Franklin Templeton and Grayscale have updated XRP ETF filings, with approval odds now estimated at 85%. ETF expert Nate Geraci describes this as a "very good sign," noting the rapid accumulation of assets in existing XRP-focused ETFs.

The XRP Ledger ecosystem shows robust growth, with RLUSD nearing $700 million in assets and transaction volume jumping 15% to $2.7 billion. Strategic partnerships with Japan's SBI Holdings and major XRPL upgrades further bolster the case for XRP's potential surge.

Asset Managers Amend XRP ETF Filings Amid SEC Scrutiny

Grayscale, Bitwise, and Canary Capital have amended their spot XRP ETF applications, signaling intensified engagement with U.S. regulators. The filings arrive as market participants anticipate a potential breakthrough for Ripple's native token in traditional finance.

Analysts interpret the coordinated updates as responsive to SEC feedback, with Bloomberg's James Seyffart characterizing the moves as "a positive but expected step" in the approval process. The regulatory delay has paradoxically fueled optimism, with traders viewing the coming months as decisive for XRP's institutional adoption.

Gemini Teases World's First XRP-Linked Mastercard Launch

Gemini has sparked speculation about launching the first XRP-branded Mastercard, following a cryptic billboard in New York City. The message, "Prepare your bags," with a date of August 25, 2025, has fueled rumors of a payment card tied to Ripple's XRP. While unconfirmed, the move could signal broader adoption for XRP, which recently surpassed $3 amid growing ETF hopes and regulatory clarity.

Unverified reports suggest a potential partnership between Ripple, Gemini, and Mastercard, with WebBank as the card issuer. The teaser aligns with XRP's recent price surge and institutional interest, though Gemini has not yet confirmed details. If realized, the card would mark a significant step toward mainstream crypto payments.

XRP Price Prediction: Technical Setup Points to Near-Term Volatility

XRP's price trajectory suggests a retest of $2.80 support within seven days, followed by a potential rally to $3.20 by mid-September 2025. Fibonacci levels and momentum indicators underpin this forecast, with immediate resistance at $3.38 and support at $2.78.

Analysts remain cautiously optimistic despite macroeconomic headwinds, including Federal Reserve policy shifts and regulatory uncertainty around crypto ETFs. Volume-based metrics like VVR and VWAP are gaining traction as reliable tools for refining price targets.

How High Will XRP Price Go?

Based on current technical indicators and market developments, XRP shows potential for a move toward the $3.40 resistance level in the near term. The combination of strong institutional interest through record CME futures open interest, ongoing partnership developments, and technical consolidation above key support levels creates a favorable setup.

| Price Level | Significance | Probability |

|---|---|---|

| $3.40 | Next major resistance | High |

| $3.10-3.20 | Immediate resistance zone | Medium-High |

| $2.83 | Critical support (Bollinger Lower) | High |

| $3.00 | Psychological support | Medium-High |

BTCC financial analyst Michael suggests that 'Given the current technical setup and fundamental developments, XRP could test the $3.40 level within the coming weeks. However, traders should monitor the $2.83 support closely, as a break below could signal deeper correction.'